A 40% Off Anker Smart Home Products sale, 30% Off Select Styles at Adidas, and an iRobot Roomba 671 lead off Friday’s best deals from around the web.

from The Root https://ift.tt/33qlGer

via

A 40% Off Anker Smart Home Products sale, 30% Off Select Styles at Adidas, and an iRobot Roomba 671 lead off Friday’s best deals from around the web.

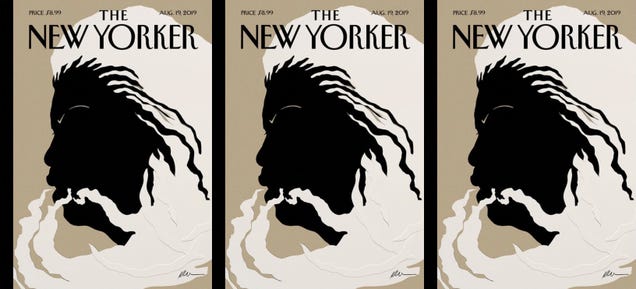

Anyone familiar with the work of Toni Morrison knew it was a force, as was the woman who wrote it. The visions Morrison rendered were both unflinching and tender, exposing the sometimes shameful truths of our natures and whispering them back to us like a lover’s secret.

The BE 100s—BLACK ENTERPRISE’s annual listing of the nation’s largest black-owned businesses—are engaging in the same tech transformations and generational shifts that have marked today’s changing business landscape.

Take the developments among the top 100 companies on the list. A transaction led by Eric Kelly, the Silicon Valley heavyweight that BLACK ENTERPRISE has identified as one of the top tech influencers, last year resulted in the emergence of a strong newcomer to the roster. Through a management-led buyout, Kelly acquired Overland Tandberg from Sphere3D, a publicly traded NASDAQ company. The San Jose, California-based data management and protection powerhouse has made its debut on the 2019 TOP 100 at No. 56 with $67 million in revenues. Another tech innovator, San Francisco-based online legal services trailblazer Rocket Lawyer (No. 60 on the TOP 100 with $60 million in revenues), has launched a new product called Rocket Wallet that uses blockchain applications for contract execution.

[RELATED: VIEW THE 2019 ‘BE 100s’ LIST OF THE NATION’S LARGEST BLACK-OWNED BUSINESSES]

Both companies represent the rising number of technology companies powering the BE 100s. Their presence also signals multiple trends that are reshaping the industrial and managerial configuration of the nation’s largest black-owned businesses. Many TOP 100 firms produced solid revenue growth. Others, however, proved less fortunate, wrestling with issues such as diminished cash flow, eroding market share, and tougher competition. Yet most have displayed canny resilience to succeed in an increasingly unpredictable environment.

In other words, the BE 100s continue to demonstrate forward momentum.

The next generation of entrepreneurial leadership has also become apparent. That is evident with the recent changes at BE 100s mainstays like James Group International in Detroit and C.D. Moody Construction in Atlanta. Another trend has less to do with the bottom line rather than a much-needed focus on community advancement and managerial pipeline development. There has been “a tremendous rise” in impact investing among black businesses, asserts Kenneth L. Harris, president and CEO of the 119-year-old National Business League. A notable example: Robert F. Smith, founder, chairman, and CEO of Vista Equity Partners (No. 1 on the BE PRIVATE EQUITY FIRMS list with $46 billion in capital under management), recently pledged to pay off student loans for Morehouse College’s 2019 graduating class, a gift estimated at $40 million. Harris says Smith also announced a new paid internship program for students of color, InternX, which will guarantee paid internships in STEM fields for 1,000 ethnically underrepresented students.

A quick look at which states have the highest number of successful black-owned business. View the complete interactive map at: https://ift.tt/2Kta973

“Black CEOs and business owners are finding innovative, but measurable ways to make a significant impact in their communities by giving to causes that will make it much easier for the next generation to succeed,” Harris says.

AUTO 40: DEALERS WRECKED BY TRUMP TARIFF

Despite the strong economy, the decline of black auto dealers continues. There were 266 minority dealers in 2018, down from 270 in 2017, reports the National Association of Minority Automobile Dealers (NAMAD), the nation’s largest minority dealership group.

The drop came largely as more dealers suffered from serious cash flow problems or received lucrative offers that made it advantageous for them to sell their franchises, says NAMAD President Damon Lester.

A major challenge for black dealers has been one that has throttled the entire industry: President Trump’s ongoing tariff campaign. Lester says dealers are paying more for cars now than a year or two ago because Trump’s tariffs have increased the costs of imported goods and parts used to make vehicles. And if Trump’s proposed 25% tariff on imported goods to the U.S. is levied this year, Lester estimates it could boost the cost of a vehicle by $2,000 to $5,000—a major blow for black dealers. “That could result in lower revenue generation and lower sales from people cutting back on wanting to buy cars or trucks,” Lester maintains. “The Trump thing is real, no joke and very serious.”

Another trend: Manufacturers’ are offering incentives to get dealers to buy more vehicles. Lester says that stimulus is causing many black dealers to take on extra inventory.

Lester is concerned by these developments because of their disproportionate impact on minority dealers. The reason: Black dealers are smaller and often can’t absorb higher costs to pay for the increased inventory unlike mainstream dealers with multiple franchises and generational wealth. “Minority dealers are starting to see a downturn now because of these trends,” he says.

FINANCIAL SERVICES: A YEAR OF PEAKS AND VALLEYS

The financial services companies have experienced it all this year, they’ve reached the apogee of peaks and fallen to the depths of valleys. For example, The Harbor Bank of Maryland and Liberty Bank and Trust Co. are working with JPMorgan Chase & Co. as part of The Financial Agent Mentor Protégé Program sponsored by the U.S. Department of the Treasury. Black investment banks, coping with the impact of new tax laws, have employed diversification to advance institutional growth. However, some investment banks showed great strength and phenomenal growth in corporate equity and debt offerings as well as M&A work. Asset managers have produced dips in assets under management. Large black private equity firms are declining in number with the notable exception of list leader Vista Equity, which continues to reign supreme. That’s why Vista Equity’s chief executive was able to retire $40 million in college debt of Morehouse graduates.

Global financial powerhouse JPMorgan Chase came to the nation’s capital earlier this year to demonstrate its new, catalytic role in bolstering African American business and economic development–efforts in building black wealth.

Managing a daylong, whirlwind schedule, dynamic CEO of Consumer Banking Thasunda Duckett, with a cadre of company officials in tow, held a roundtable at the RISE Demonstration Center in Southeast Washington to discuss community business initiatives as well as announce Chase’s $3.65 million commitment—along with $2 million from Capital Impact Partners and $1 million from A. James & Alice B. Clark Foundation—to expand capital access through its Entrepreneurs of Color Fund. (Already, the institution has developed EOC funds in Detroit, Chicago, San Francisco, and the South Bronx.) Next stop: A career development session with students at Howard University, featuring Carolina Panthers quarterback and entrepreneur-philanthropist Cam Newton and NBA superstar LeBron James’ business partner Maverick Carter, among other notables. The last event is an evening mixer at the impressive Newseum highlighted by an engaging discourse among former Secretary of State Colin Powell, Mellody Hobson, co-CEO of Ariel Investments (No. 1 on the BE ASSET MANAGERS List with $11.6 billion in assets under management) and JPMorgan Chase CEO Jamie Dimon on wealth building in black communities.

Together, these activities introduced Advancing Black Pathways, the audacious initiative from the nation’s largest bank to drive prosperity for African Americans while addressing persistent racial and economic barriers to wealth creation in partnership with a range of influential companies, organizations, and leaders. In fact, the Advisory Council includes Powell, Hobson, Carter, former Secretary of State and Stanford Business School Professor Condoleezza Rice, National Urban League CEO Marc Morial, and Sundial Brands Founder and Essence Communications Owner Richelieu Dennis. In addition to designing financial management programs and career development opportunities, business expansion represents a core component of ABP. Asserts Dimon, who has mandated initiatives such as Advancing Black Leaders to promote African American talent within the firm and AdvancingCities to use public–private partnerships to rebuild urban hubs like Detroit: “One of our responsibilities as a firm is to expand opportunities for everyone. We’ve seen great success with our targeted efforts to create opportunities for women and veterans. I’m confident that Advancing Black Pathways will be equally successful and a model for other organizations.”

Dimon’s certainty is in large part due to ABP executive sponsor Duckett who has a laser-beam focus on its game-changing impact. (Sekou Kaalund serves as managing director and Head of ABP.) The following are edited excerpts of Duckett’s recent interview with BE about the program’s significance:

What has been the evolution of ABP? Heading into 2020, what does success look like in terms of goals and objectives?

You said at the very beginning, “the evolution of the program,” and that’s exactly what it is in terms of always trying to do more and challenge ourselves on how can we make more of an impact, and for this conversation, specifically within the black community. As I think about Advancing Black Pathways, it’s really the same way I think about everything that we do at Chase, and clearly, as I think about how I lead the Consumer Bank. It really starts with being intentional about what we’re looking to accomplish. As you should see when you look at our business performance, it’s with that intentionality that we are making improvements with our customer experience, delivering the results for our shareholders, or all the work we’re doing in communities.

What do you view as the major obstacles that need to be addressed?

Opportunity is not distributed equally, but we all know that talent is. Being black and really focusing on this initiative, it really rings true. I would highlight two challenges. We know that the economic wealth gap facing black Americans is stark. We also know [about] the business gap, in terms of people of color owning businesses at the same rate as whites. That outcome would mean or result in 9 million more jobs and $300 billion in worker income. So Advancing Black Pathways is really focusing on expanding economic opportunity for black Americans.

Usually, when you look at a program like this, it focuses on minorities, and depending on how that’s defined, that term can be expansive or narrow. Chase, however, seems intentional in its multipronged focus on African Americans as opposed to other ethnic groups and races.

Absolutely. And I think that’s important. Having this intentionality means that as we think about metrics and outcomes, we are not putting it all together to say collectively we made progress but looking specifically at how we’re making progress within the black community.

That is why advancing is at the top of the name. The reason why we said pathways is because we know that to make this impact, it’s not enough to have one path. So as a community, as a business, all of these different pathways and solutions have to be connected in order to advance the progress of African Americans. It’s not a straight line. Think about the work we’ve done at the firm already, like Advancing Black Leaders, the Fellowship Initiative, Entrepreneurs of Color Fund…the work that we’re doing with low- to moderate-income communities, the financial health efforts that we’re leading and are super passionate about. That’s an example of recognizing it’s not one thing that’s going to advance the economic impact for black communities. It’s all of these pathways and the intersection of them that gets you to the outcome.

What are some innovative initiatives in which black business may benefit?

We [announced] hiring 1,000 black scholars over the next several years, whether that’s through our summer internships [or] our apprenticeships. By giving them access to an earlier start, that will lead to greater opportunity for success when they enter the workforce. But I would also say it’s not just the number of interns, it’s what we’re going to do around that strategy that I think is going to be meaningful. One example is to have our interns [spend] two to three weeks supporting a black business. So it is about understanding a problem that a black business is trying to solve and taking some of the best young minds that come to JPMorgan Chase to work with that black business on a particular effort so that we’re lending our human capital, giving these interns exposure, and then ultimately, collectively demonstrating the intersection between small business and JPMorgan Chase. I’m super excited about that.

In the rich tapestry of history, the threads of Black LGBTQ+ narratives have often been overlooked. This journey into their stories is an ...